Same here! Just bring it to me before Delhi decides to reinstate the lock-down like Chennai has!

My KYC issues is resolved and Approved. Hope you all have smooth process.

My Customs clearance is happening in Bangalore may be bcz the destination is Hyderabad.

same here. update now: Clearance processing complete at BANGALORE - INDIA

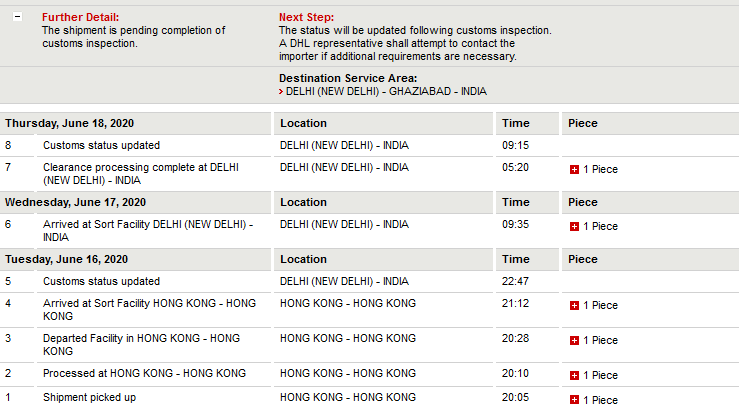

Mine is on the same status as above since morning. If it does not move from “Customs inspection” by EOD, hopes of getting it tomorrow are really low.

In this case who is the importer ?

In that case we might have a different amount for each person. Someone might be early bird and some might be without discount.

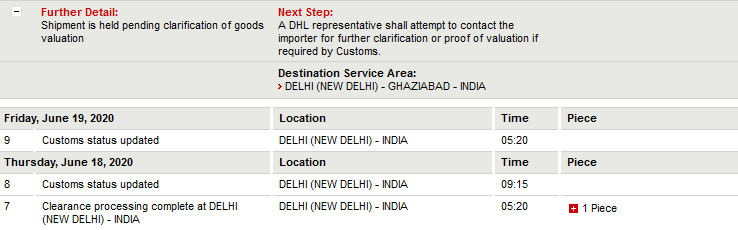

I think DHL should ask us to provide the invoice copy of the purchase/support. So they can produce the same and calculate the duty.

Nope …everyone bought at diff price…check with steve.

Don’t overshoot.this is why import duty was excluded mid way bcs of our overshoot…

Let philips handle it…

Don’t get overexcited

Do not contact dhl

obviously we are importing this so it is us.

That is correct. Ideally the customs should be on the amount we paid for the device.

No, There should be an invoice attached with the shipment. We shouldn’t be the ones providing that to DHL/customs department. Just that we have to wait a bit more to get this sorted.

That’s not possible.

Imdevu price of the pico can’t b diff for all.it will be the CiF.

Again get excited when all this is done.

Dhl has experience in handling it.

That’s all I’m saying

I am not calling them up for now, I will be waiting.

Does it matter to the customs inspector if the unit is a gift or reward or prize won?

What matters is CIF.price u fix and gift is diff but cant b in bulk

i think only samples upto INR 10000 (115 EUR/130 USD) are exempt.

Here is something from DHL KYC website:

-

Import of goods including those purchased from e-commerce portals, where Customs clearance is sought as gifts will attract full applicable Customs Duty. Only Lifesaving Drugs / Medicines and Rakhi (but not gifts related to Rakhi) up to accessible value of INR 5,000/- will be exempted from duty.

-

Bonafide “Samples” upto value INR 10000 have duty exemption.

For me when i purchased an item from alibaba worth 7000 I got import tax of 700 INR.

probably not electronics!

That’s a fixed price…here everyone bght at a diff price but for customs it dsnt matter bcs thts philips internal matter.

They need a single price.

Anyway I guess it shd b sorted out by the end of the day.not to worry.

Chalo enuf discussion .let’s wait