Hooray!!  soon!

soon!

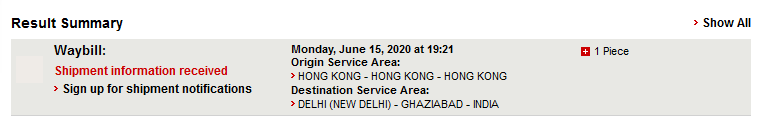

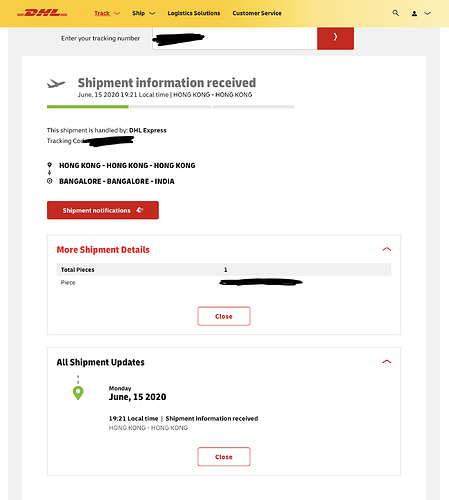

No I can see the tracking only passport was missing earlier. Even there is movement in tracking also.

Very eagerly waiting

Do anyone know will DHL do delivery or Indian post will do it?

When will they collect tax?

U really want to pay ? Hehe…

Tax will be collected either when the shipment gets a flight or before arrival I guess.

Status updated for Bangalore

Now let see how fast government need their custom charges. Based on my previous indiegogo backing they hold the items for atleast a month and force us to visit GPO.

Hope this time DHL will manage from their side and deliver at doorstep.

BTW just shipment information received by DHL but this is the first step toward the delivery of PPM.

If it’s going to India post then they will open the package and check the device and pack it back. But if it’s coming from DHL then they are paying in advance and collect the same money from us during delivery.

Wish it will not go to India Post. They are screwing our device and till the clearance happens we need to wait for our package. I had bad experience with multiple items they make almost a month to wait after they receive the product.

Ur lucky…urs cmng on air india flight…

Shd arrive on 18th nite in Bangalore if it’s the flighy I know

What gpo ?

Dhl will manage.

At the delivery time or they will update you via email and send their account details. You may opt for the COD also.

If it will be delivered by India Post then either you need to go to your city’s GPO, pay and collect the same. Or during the delivery you can also pay as COD.

I think dhl wl handle a device like this…

India post good only for ali express

@Zac shared this earlier:

I doubt, India post is involved in this, but this is my assumption only.

GPO stands for General Post Office. The main post office of the city is called GPO. For example Bangalore pincodes starting from 560001 which is the first pincode assigned to post office and that become GPO.

Just thought I’d chime in here since it’s the same situation for me in Pakistan. My father has extensive experience with customs and courier companies and advised me to write an email to DHL with the AWB/Tracking number and request on-arrival clearance telling them that you will pay all duties and taxes. That way you reduce the risk of customs tossing around your device, detaining it or unnecessarily delaying it. Hope this helps someone.

What option do we have, we need to pay anyway. Some lucky people might not get tax.

I had the same experience, they almost damaged the product I ordered. The seller added 2 layers of bubble wrap that helped.

All fellow hindustanis

Guys kyc sms has come …pls upload asap either aadhar or passport with matching address …

So that our delivery dant get delayed

Is it SMS or email? I have not received either of them!!!

@imdevu You have to add in notification when u start tracking …any way all of u can upload here

Address shd b same …

Do it now

https://www.dhlindia-kyc.com/forms/login.aspx

Pan,aadhar,passport ,voters I’d but mind u .

Address shd b the same or addl dox reqd.

This is the url

https://www.dhlindia-kyc.com/forms/login.aspx

Received via SMS:

Dear Customer, for your shipment via DHL AWB xxxxxxxxxx, visit www.dhlindia-kyc.com to upload document and for help click on list of valid KYC documents. Please ignore if already done.

Anyone importing this as a non individual? I have a question if anyone is using a GST number to claim the tax? It seems to be asking me for an IEC number which I am unsure of.

It seems they don’t have it on dhl record here so I’m not sure u shd bother as dhl wanted us to upload our kyc document.

Seems just the number won’t be enough.

Address shd b the same.